As the business scales, so do the companies rely more on travel. Following on the traditional manual methods like collecting a stack of receipts, manually reconciling the expenses, filling in the reimbursements forms and more have become unsustainable in the long run.

As businesses and corporations have seen a remarkable surge in traveling, mandating to integrate technology has become the need of the hour. “In 2024, 20% of travellers expect to take six to 10 trips, and 10% say they will take more than 10 trips.”- Consumer

Therefore, shifting the paradigm towards modern travel and expense management software becomes vital for smooth operations. According to a survey, firms that adopted Travel and Expense Management (TEM) systems were able to increase the efficiency of their reimbursement processes by 71%, improve their visibility over spending by 66%, and reduce processing costs by 53%.

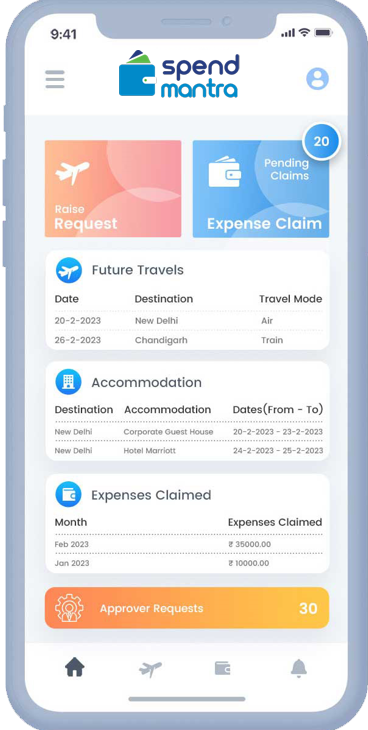

The SpendMantra Travel & Expense Management software not only automates expense tracking but also helps organizations optimize their budgets and continue to improve.

Read the blog and explore the traditional challenges, the role of travel and expense management software in transforming businesses, its benefits, and why corporations and organizations must consider it.

Table of Contents

Challenges Traditional Businesses Faced

Before the implementation of software, businesses completely relied on manual data entries and processes to manage tour expenses. With a plethora of tasks to be done, the probability of human errors and lost receipts is higher. Also, as the organizations scale, it becomes more complicated to handle such tasks. Say for example, tracking per-diem allowances, reconciling international expenses, and ensuring adherence to company travel policies can become a logistical nightmare without a digital solution.

Why is it Time for Businesses to Make a Shift?

As discussed above the challenges of a traditional travel expense management, shifting towards a modern yet efficient expense management software is the rescue. Below are a few critical benefits offered when organizations adopt such technology.

- Optimized Workflow and Precision

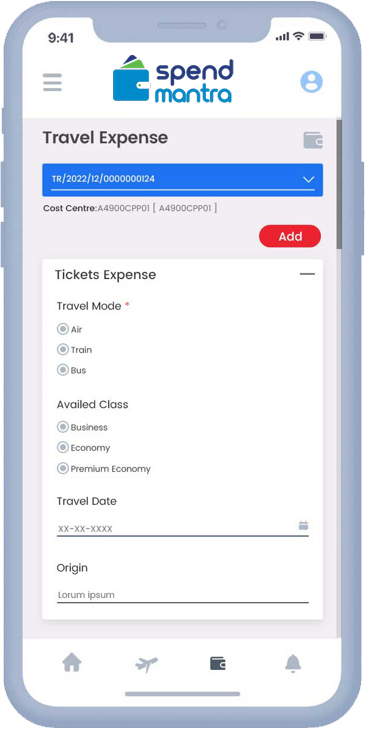

Moving from a manual to an automated expense management system eliminates the need for repetitive tasks, data entries, and collecting receipts, ultimately reducing human errors. With the integration of software, there is real-time tracking of expenses that ensures more accuracy and precision.

- Improved Compliance

Most organizations send their employees for the tours, however, they may breach the travel policies that are decided by the organization. It ultimately leads to overspending and escalates issues further.

With the travel and expense management software, organizations can seamlessly ensure compliance by enabling real-time alerts for any violations of corporate travel policies. It enforces the spending limit and alerts the authority when the expense exceeds the threshold, making it quite reliable.

A startup used SpendMantra Travel & Expense Management to set strict daily travel budgets. The software flagged excessive spending on transportation or meals, ensuring employees adhere to company policies. This reduced unauthorized expenses and improved budget control.

- Budget Control

When the updates are received in real-time, there is more effective management of the budget and employees do not overspend. Travel and expenses management software is the savior that allows the managers or the authorities to keep track of the expenses and keep transparency into how the resources are being allocated and used. The transparency makes it easier to enforce travel policies and adjust spending as needed.

A marketing agency used SpendMantra Travel & Expense Management to manage travel expenses effectively. The software highlighted cost-effective travel options for employees and allowed managers to set limits.

- Improved Reports and Analytics

It is another crucial benefit of adopting travel and expense management software. With detailed reports and analytics, businesses can have valuable insight into employee spending while enabling data-driven decisions to optimize budgets. With detailed analysis, organizations can predict future spending based on past data, point out recurring policies and address them proactively, and a lot more.

According to SpendMantra Travel & Expense Management system, advanced analytics provide travel managers with granular visibility into expenses. For instance, managers can monitor real-time policy violations, assess spending by department, and analyze trends to refine budgets and policies.

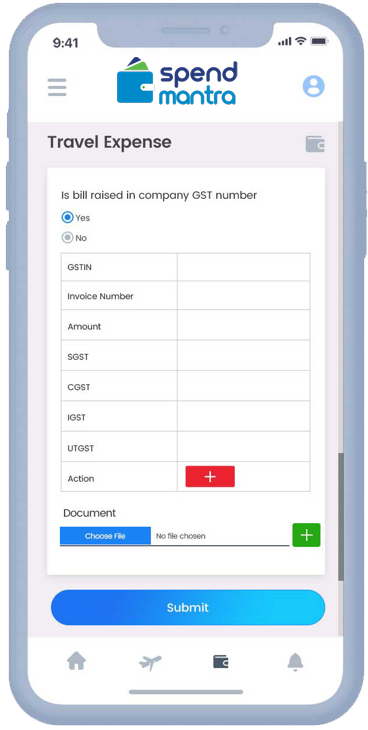

- Mobile Access and Flexibility

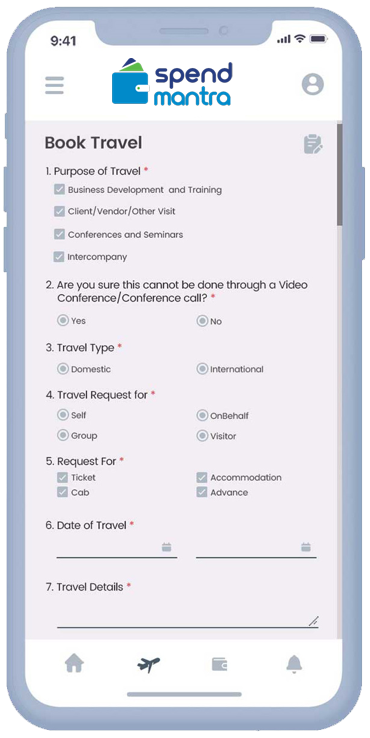

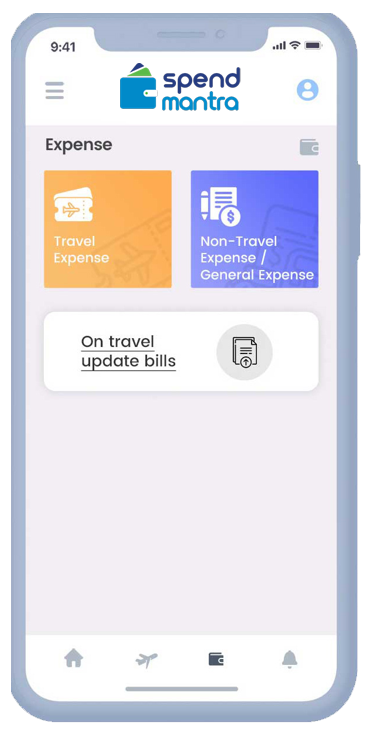

It is one of the standout benefits of travel and expense management software, which significantly helps with improved flexibility for employees and management. From capturing receipts to uploading them, or tracking expenses in real-time, the mobile access offers more flexibility.

For example, when employee travels internationally, they can quickly convert currencies within the app, categorize expenses according to the company’s policies, and submit reports with just a few taps. This convenience eliminates the hassle of keeping track of physical documents or delayed submissions.

- Global Reach

With multiple currency usage, booking taxis, different tax regulations in different countries, and local compliance issues, there is always a hassle. Here comes the expense management software that can seamlessly. The scalability allows businesses to manage their travel expenses no matter at what part of the world they are traveling.

Here’s your takeaway!

In an era where efficiency and precision are of utmost value and help drive business success, integrating such software becomes a necessity. From automating repetitive tasks to ensuring global scalability, such tools are transforming how companies manage their travel expenses.

Wish to revolutionize how your business manages travel expenses? Discover the power of Enaviya SpendMantra Travel & Expense software to simplify processes, enhance compliance, and drive smarter financial decisions.